Creation of Payroll Masters

The Payroll feature in Tally.ERP 9 requires minimal effort for accurate payroll processing. It takes five easy steps to process payroll & generate Pay Slip in Tally.ERP 9.

Employee Setup (Payroll info.)

Employee Master records employee information – department, date of joining, date of leaving, ID number, designation, location, function, employee bank details, statutory details, Passport and Visa details, and so on. Tally.ERP 9 provides the flexibility to create the Employees and Group them under specific Employee Group which in turn can be created under specific Employee Categories. The following masters can be created in Tally.ERP 9 to successfully record the Employee Details

1. Employee Category

2. Employee Groups

1.Select Primary Cost Category as the Category (You can also create a separate cost category to segregate Employee Cost based on respective categories)

2.Type Sales as the Name of the Employee Group

3.Select the group as Primary (Tally.ERP 9 allows an unlimited grouping of Employee Groups) Businesses with multiple departments, divisions, functions or activities may create the required employee groups and classify individual employees under a specified group i.e., Production, Sales, Marketing, Stores, Support or a particular group of employees such as managers, supervi-sors, sub-staff and so on. To create Sales as an Employee Group: Go to Gateway of Tally > Payroll Info. > Employee Groups > Create In the Employee Group Creation screen,

The Employee Group Creation screen is displayed as shown:

Press Enter to Accept the Employee Group Creation screen

3. Employees

Create the following Employee Masters: Go to Gateway of Tally > Payroll Info. > Employees > Create In the Employee Creation screen,

1. Select the Primary Cost Category as the Category

2.Type the Name of the Employee as mintoo

3.Specify the Name of the Employee Group as Administration in the field ‘Under’

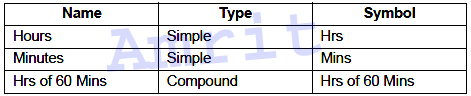

4. Units(work)

A payroll unit refers to a unit of measurement based on which pay heads are calculated.

i. Simple Payroll Units

1.Simple is defaulted as the Type of Unit

2.Specify Hrs as the Symbol

3.Type Hours as the Formal Name

4.Specify 2 as the Number of Decimal Places Go to Gateway of Tally > Payroll Info. > Units (Work) > Create In the Unit Creation screen,

The completed Unit Creation screen is displayed as shown:

ii. Compound Payroll Units

1.Press Backspace and select Compound as the Type of Unit

2.Specify Hrs as the First Unit

3.Enter 60 as the Conversion Create Hrs of 60 Mins as a Compound Unit. In the Unit Creation screen:

4.Specify Mins as the Second Unit

5. Attendance/ Production Types

Attendance/Production Type masters are used to record the nature of attendance/ production i.e., time and work rate.

i. Present Attendance Type

1.Type Present as the Name of the Attendance type

2.Specify the group as Primary in the field ‘Under’. By default primary is selected. Go to Gateway of Tally > Payroll Info. > Attendance / Production Types > Create In the Attendance Type Creation screen,

Absent

Overtime

6. Pay Heads

Pay Heads may be broadly considered as Earnings and Deductions from an employee’s point of view. However, these pay heads would still be Expense and Liability from the employer’s view point.

Basic

(Basic) Attendance based Earnings Pay Head

1. Go to Gateway of Tally > Payroll Info. > Pay Heads > Create .

The Pay Head Creation screen appears, as shown below:

2. Enter the pay head name in the Name field.

3. Select Earnings for Employees f rom the List of Pay Head Types , in the Pay head type field.

4. Select Income t ype for the pay head as:

o Fixed: This forms a part of the employee’s Total Gross Salary . For example , Basic Pay.

o Variable: This forms a part of the employee’s Total Earnings only. For example , Overtime Wages.

5. Select Indirect Expenses from the List of Groups in the Under field.

6. Set Affect Net Salary to Yes , if you want the pay head to affect the net salary.

The Name to appear in Payslip field displays the pay head Name by default. You can change the name, if required.

7. Set Use for calculation of gratuity to Yes , to consider this pay head for Gratuity calculation.

8. Set the option Set / Alter Income Tax Details to Yes to view the Income Tax Details screen.

9. Select the required tax component ( for example , Basic Pay) in the Income Tax Component field.

10. Select On Projection as the Tax Calculation Basis , if tax computation is spread across the remaining period.

11. Set the option Deduct TDS across Period(s) to Yes when Tax Calculation Basis is On Projection. It can be set to Yes or No for On Actuals, as required.

12. Select On Attendance as the Calculation type .

13. Select the required method of recording attendance.

14. To deduct salary for the number of days an employee is absent (Leave without Pay),

o Select Not Applicable for Attendance/leave with pay field.

o Select Absent in the field Leave without pay field.

15. Select Present in the Attendance/leave with pay field the Present Attendance Type and follow the remaining steps.

16. Select the required Calculation period from the List of Calculation Periods .

17. Based on the Calculation period , you can select and enter the details for Per Day Calculation Basis as User Defined or Calendar period orUser Defined Calendar Type.

18. Select the Rounding Method , if applicable.

19. Enter the desired rounding limit.

House rent allowance

Conveyance

Over time

variable

PF

Employees’ PF Deduction pay head

1. Go to Gateway of Tally > Payroll Info. > Pay Heads > Create.

The Pay Head Creation page appears as shown below:

2. Enter the name of the Pay Head in the Name field.

3. Select Employees' Statutory Deductions as the Pay Head Type from the list of Pay Head Types.

4. Select PF Account (A/c No. 1) in the Statutory Pay Type field.

5. Select Current Liabilities from the List of Groups in the Under field.

6. By default, Affect Net Salary is set to Yes . Type No, if you do not want this component to be included in the pay slip.

7. By default, the pay head component name entered in the Name field appears in the pay slip. Enter the Name to appear in Payslip if you want to change the default pay head component name.

8. By default, the Calculation Type field is set to As Computed Value , and the Calculation Period field is set to Months .

9. Select Normal Rounding from the list of Rounding Methods , and type 1 as the rounding Limit.

10. Select On Specified Formula , from the Computation On list, in the Compute field. The Computation on Specified Formula sub-screen appears.

● In the Pay Head column, select Basic Pay from the List of Pay Heads and select End of List to return to Pay Head Creation .

11. Enter the desired date in the field Effective Date field, when the PF deduction begins.

12. Select Percentage from the List of Slabs in the Slab Type field.

13. Enter the required percentage for PF in the Value Basis field.

14. Press Enter to accept.

Employees' ESI Deduction Pay Head

1. Go to Gateway of Tally > Payroll Info. > Pay Heads > Create.

2. Enter the name of the Pay Head in the Name field.

3. Select Employees' Statutory Deductions as the Pay head type from the List of Pay Head Types.

4. Select Employee State Insurance in the Statutory Pay Type field.

5. Select Current Liabilities from the List of Groups in the Under field.

6. By default, Affect net salary is set to Yes . Type No , if you do not want this component to be included in the pay slip.

7. By default, the pay head component name entered in the Name field appears in the pay slip. Enter the Name to appear in Payslip if you want to change the default pay head component name.

8. By default, the Calculation type field is set to As Computed Value , and the Calculation period field is set to Months.

9. Select Normal Rounding from the list of Rounding Methods and type 1 as the rounding Limit.

10. In the Compute field, select On Specified Formula from the Methods of c omputation list. The Compute sub-screen appears.

11. In the Pay Head column:

● Select Basic Pay from the List of Pay Heads.

● Select Add Pay Head to add each pay head that is used for ESI calculation.

● Select End of List to return to Pay Head Creation.

12. In the Effective Date field, enter the desired date when the ESI Deduction begins.

13. By default, the Slab Type field is set to Percentage.

14. Enter the percentage value in the Value Basis field.

15. Similarly, enter the From Amount , Amount Upto , Slab Type and Value details for the next slab.

Professional Tax

Professional Tax Deduction Pay Head

1. Go to Gateway of Tally > Payroll Info. > Pay Heads > Create

2. Enter the name of the Pay Head in the Name field.

3. From the list of Pay head Types , select Employee’s Statutory Deductions as the Pay head type.

4. Select Professional Tax in the Statutory Pay Type field and enter the Professional Tax Registration Number in the adjacent field.

5. Select Current Liabilities from the List of Groups in the Under field.

6. By default, Affect net salary is set to Yes . If you do not want this component to be included in the pay slip, type No.

7. By default, the pay head component name entered in the Name field appears in the pay slip. Enter the Name to appear in Payslip if you want to change the default pay head component name.

8. By default, the Calculation type field is set to As Computed Value.

9. In the Calculation period field, select Month or Period to specify the frequency of PT deduction as monthly or based on a certain period respectively.

10. Select Normal Rounding from the list of Rounding Methods , and type 1 as the rounding Limit .

11. In the Compute field, select On Current Earnings Total from the Methods of c omputation list.

12. In the Effective Date field, enter the date from when Professional Tax will be effective.

13. Enter the required value in the From Amount and Amount Up to fields.

14. Select Value from the List of Slabs in the Slab Type field.

15. Enter the amount for Professional Tax for each slab in the Value field.

7. Salary Details

The Salary Details masters contain information on the Employee Group/ individual employee pay structure, comprising of both earnings and deductions pay components for the applicable period.

To define Salary Details for employees,

Go to Gateway of Tally > Payroll Info. > Salary Details > Create

1. Select Ajay from the List of Employees and press Enter

In the Salary Details screen,

1 The Effective date is entered as 01-04-2009 by default based on the Date of Joining entered in the Employee Master

2 select Basic Pay as the Pay Head from the List of Pay Heads Specify 10,000 as Rate

3. the Attendance units, Pay Head Type and Calculation Type appear by default, based on the pay head definitions.

इसी तरह जितने भी कर्मचारी होंगे सबकी डिटेल्स भर देंगे

0 Comments